10 Tips to Shield Your Android Device from Banking Threats

In an era where our smartphones are central to our daily lives, ensuring the security of our Android devices is paramount, especially when it comes to banking transactions. With cyber threats evolving, it’s essential to stay a step ahead in safeguarding your financial information. Let’s explore 10 practical and intriguing tips to fortify your Android device against banking threats.

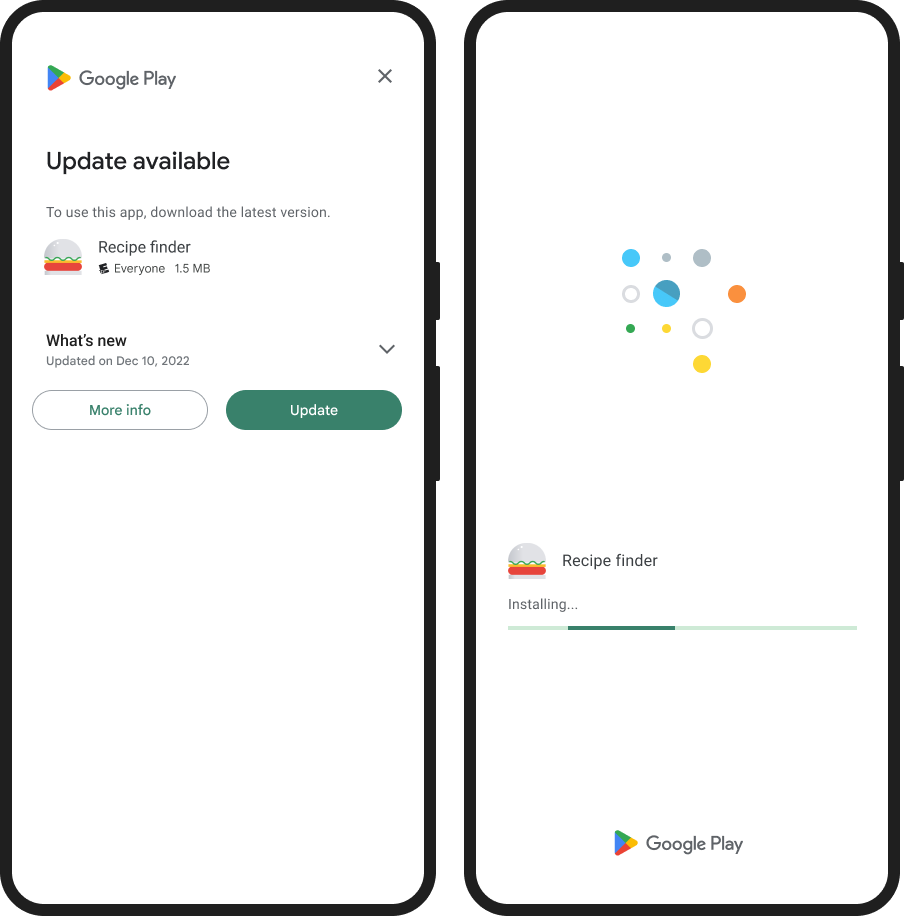

- Update Your Apps and Operating System Regularly: Just like your computer, keeping your Android apps and operating system up-to-date is crucial. Developers release updates to patch vulnerabilities, ensuring that your device stays one step ahead of potential threats.

- Enable Two-Factor Authentication (2FA): Adding an extra layer of security to your banking apps through two-factor authentication provides an additional barrier for unauthorized access. Opt for 2FA methods like SMS verification or app-based authentication for enhanced protection.

- Install a Reputable Mobile Security App: Invest in a trustworthy mobile security app that offers real-time protection against malware, phishing, and other threats. Regularly scan your device to detect and eliminate potential risks.

- Use Strong and Unique Passwords: Crafting robust, unique passwords for your banking apps is a fundamental step in securing your financial information. Avoid using easily guessable passwords, and consider using a reliable password manager for added convenience.

- Beware of Phishing Attempts: Stay vigilant against phishing scams that attempt to trick you into revealing sensitive information. Avoid clicking on suspicious links or responding to unsolicited messages, and always verify the authenticity of communication from your bank.

- Secure Your Wi-Fi Connection: Conduct your banking transactions on secure Wi-Fi networks. Public Wi-Fi can be a breeding ground for cyber threats, so refrain from accessing sensitive information when connected to unsecured networks.

- Review App Permissions: Regularly review the permissions granted to your banking apps. Ensure they have the minimum necessary access to your device’s features and data, minimizing the risk of unauthorized activities.

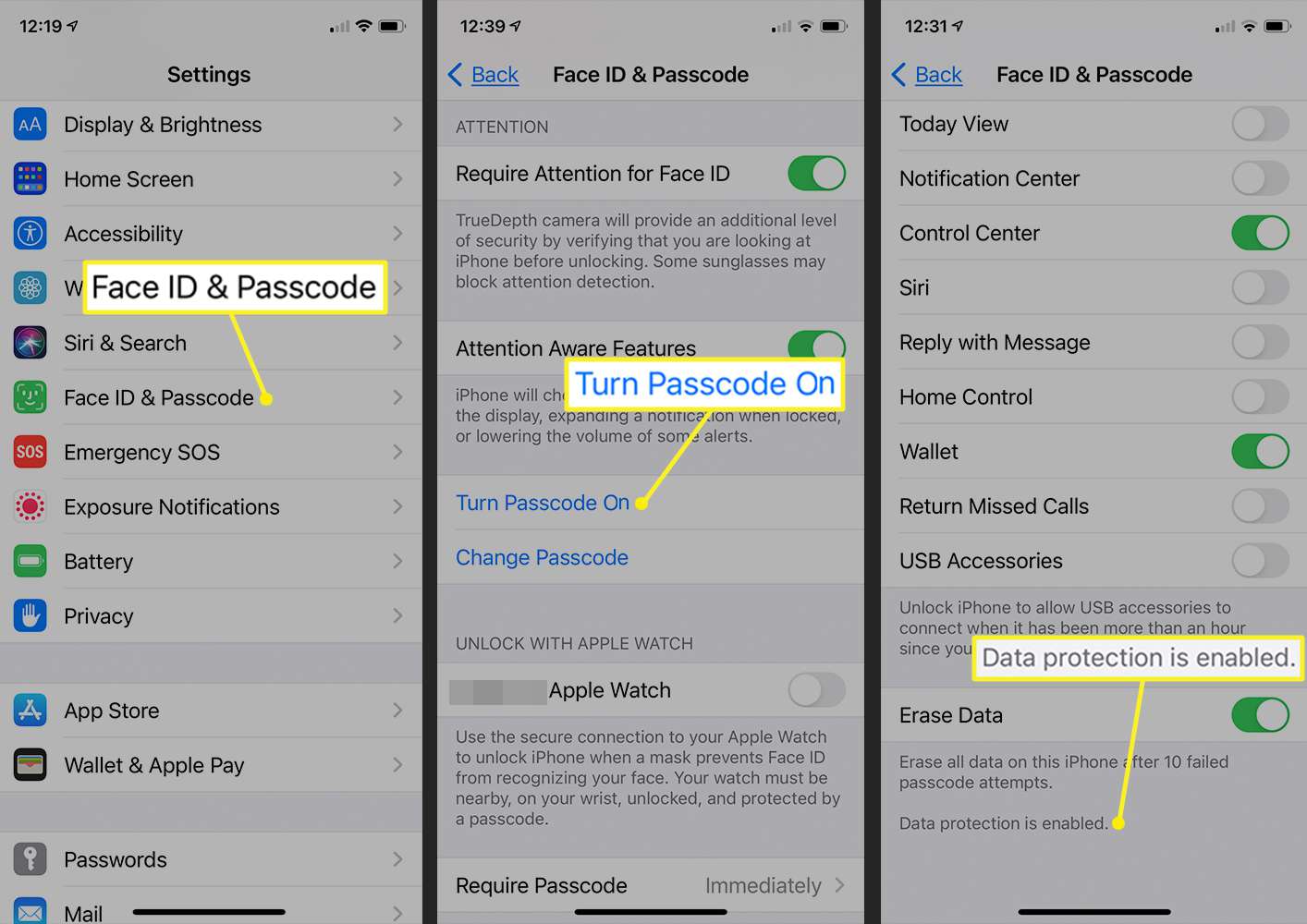

- Encrypt Your Device: Enable encryption on your Android device to protect your data in case it falls into the wrong hands. This additional layer of security ensures that even if your device is lost or stolen, your banking information remains inaccessible.

- Log Out After Transactions: Cultivate the habit of logging out of your banking apps after completing transactions. This simple step prevents unauthorized access, especially if your device is shared or misplaced.

- Monitor Your Accounts Regularly: Stay proactive by regularly monitoring your bank statements and transactions. Report any suspicious activity promptly to your bank and take immediate action if you notice any unauthorized transactions.

Conclusion:

Your Android device is a gateway to your financial world, and securing it from banking threats is a responsibility we all share. By adopting these 10 tips into your digital habits, you not only fortify your device but also contribute to a safer digital landscape. Stay informed, stay secure, and enjoy the convenience of digital banking with peace of mind.