Navigating Economic Waves: Egypt’s Inflation Dips, but Challenges Loom

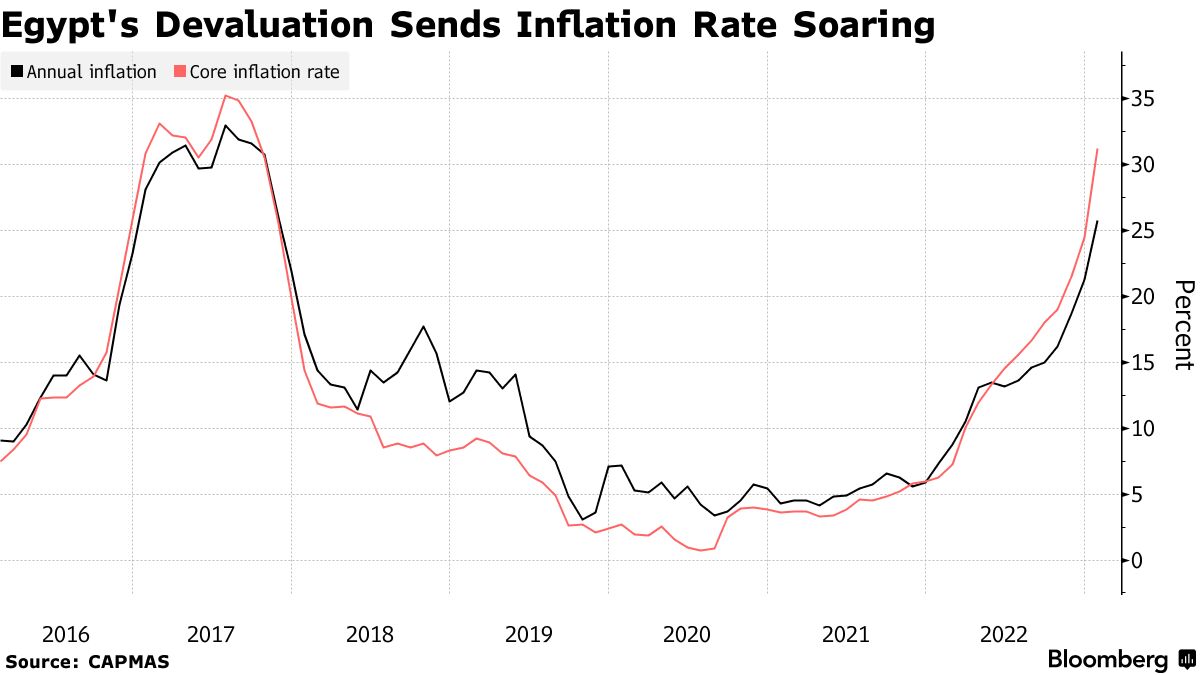

In a promising turn of events, Egypt witnessed a third consecutive month of declining inflation in December, marking the slowest rate since May, according to data from the country’s statistics agency, Capmas. However, the elation may be short-lived as speculation grows regarding a potential devaluation of the Egyptian pound in the coming weeks.

Consumer prices in urban areas saw a year-on-year growth of 33.7%, down from 34.6% in November and 35.8% in October. This positive trend, though, faces potential disruption if Egypt decides to devalue its currency once again. The implications of such a move extend beyond economic intricacies, as it directly impacts the already soaring prices, particularly in the essential sector of food.

Egyptian farmers harvest wheat in Saqiyat al-Manqadi village in the northern Nile Delta province of Menoufia in Egypt, on May 1, 2019. (Photo by Mohamed el-Shahed / AFP) (Photo credit should read MOHAMED EL-SHAHED/AFP via Getty Images)

Egypt has undergone three devaluations of its pound since early 2022, resulting in a 50% depreciation. The official exchange rate has the dollar trading at around 31 pounds in banks, but on the parallel market, it’s exchanged for approximately 50 pounds. This devaluation, coupled with a persistent foreign currency shortage and rapidly growing debt, has created an economic crisis.

President Abdel Fattah El Sisi‘s administration faces the daunting task of managing a ballooning debt that consumes a substantial portion of state funds. Despite efforts to increase the size of a $3 billion rescue package with the International Monetary Fund (IMF), the lack of foreign exchange flexibility and a slow pace in selling state assets have complicated the process.

As the IMF review gets repeatedly delayed, external factors like the fallout from the war in Sudan and the Israel-Gaza conflict add to Egypt’s economic challenges. This week, US Treasury Secretary Janet Yellen is scheduled to meet top Egyptian finance officials in Washington, aiming to advance discussions on expanding the $3 billion rescue package.

Despite the hurdles, there is a glimmer of hope. The risk of another devaluation looms large, but a potential spike in inflation this month may be offset by a favorable base effect, as noted by Nadeem Brokerage. The brokerage firm anticipates a January 2024 annual inflation reading closer to 30%, assuming no changes to the official exchange rate.

The economic crisis is a point of contention, with the government attributing it to external factors like the Covid-19 pandemic and the Russia-Ukraine war. Critics argue that excessive borrowing and non-essential mega projects are contributing factors. Infrastructure initiatives, including new cities, electric trains, and monorails, have been defended by President El Sisi as crucial for modernization and attracting investors.

In the midst of these economic waves, Egypt’s leadership faces the challenge of steering the nation towards stability. With inflation showing signs of easing, the journey ahead involves addressing the root causes, fostering financial resilience, and making strategic decisions to secure the economic well-being of the country and its people.